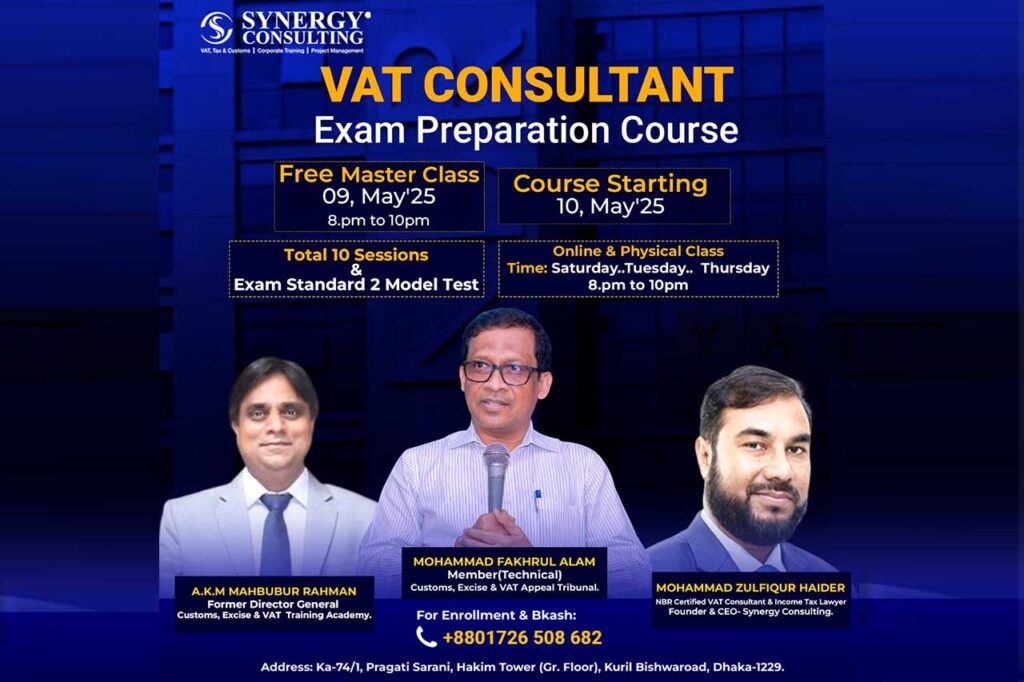

701 : VAT Consultant Exam Preparation Course

Course Contents & Division wise allocated sessions against Total 100 Marks

Division-01: VAT & SD Act-2012 & Rules-2016 (5 Sessions) 40% Marks

1. Session-01:

Topic: Overview of Value Added Tax & Supplementary Duty Act.2012 & Rules-2016. VAT and SD related important definitions and discussion of conceptual issues with 1st

& 2nd Schedule of VAT & SD Act 2012.

Trainer: Mohammad Zulfiqur Haider

NBR Certified VAT Consultant & Income Tax Lawyer

2. Session-02:

Topic: VAT Registration & Central VAT Registration, Books of Accounts in VAT and Functions of VAT 6.1, 6.2, 6.2.1, 6.3, 6.4, 6.5, 6.6, 6.7, 6.8 & Preparation of Input Output

Co-efficient VAT 4.3.

Trainer: Mohammad Fakhrul Alam,

Member (Technical), Customs Excise & VAT Appeal Tribunal.

3. Session-03:

Topic: Imposition of VAT, VAT Rebate Mechanism, Output Tax Calculation, Input Tax Credit and Preparation of VAT Return VAT 9.1, Turn Over Tax and Return-VAT 9.2

Trainer: A.K.M Mahbubur Rahman

Former Director General, Customs Excise & VAT Training Academy, Chattogram.

4. Session-04:

Topic: Different types of VAT Rates, Calculation of VAT able Price, VAT & AT, AIT in Import Assessment, Exam Question solution on Increasing & Decreasing adjustment,

VAT-4.3, VAT-9.1

Trainer: Mohammad Zulfiqur Haider

NBR Certified VAT Consultant & Income Tax Lawyer

5. Session-05:

Topic: NBR-VAT Wing’s Administration, VAT Authority, Trial & Offence, Punishment, Appeal Tribunal & Alternative Dispute Resolution (ADR) and relevant SROs.

Trainer: A.K.M Mahbubur Rahman

Former Director General, Customs Excise & VAT Training Academy, Chattogram.

Division-02: Customs Act-2023 (2 Sessions) (25% Marks)

01: Overview of Customs Act’2023 with Definitions, Offence, Penalties, Adjudication & ASYCUDA:

Trainer: A.K.M Mahbubur Rahman

- Important Definitions & Abbreviations under Customs Act’2023.

- Important Differences like UD-UP, Refund-Drawback, FOB, CIF etc.

- Offence, Penalties and appeals under Customs Act-2023.

- Adjudication, Power of Adjudication, Appeal Tribunal, ADR etc.

- Program & Activity of ASYCUDA World & Single Window systems.

02: Customs Assessment, Duty and Taxes Calculation and Clearance Procedure in Export & Import.

Trainer: Mohammad Fakhrul Alam

- Customs formalities for Export & Import.

- Documents require for IGM, Bill of Entry and Customs Assessment.

- Major Customs Procedure- Customs Assessment and Clearance procedure.

- Different types of Customs Assessments.

- Key Functions of Customs and Laws implemented by Customs

- Calculation of Duties & taxes, Payment of Duties & Taxes.

Division-03: Import-Export Policy, FEx Act.1947, IM.EX Act.1950 (1 Session) 15% Marks

Trainer: Mohammad Fakhrul Alam

01. Overview of Import-Export Policies and related Acts and Last year’s Exam Question.

- Import Policy Order 2021-2024

- Export Policy 2024-2027

- The Foreign Exchange Regulation Act-1947

- The Import and Export Control Act-1950

- Previous Question related Question answer session.

Division-04: General Mathematics (1 Session) 10% Marks.

Trainer: Mohammad Zulfiqur Haider

- Focus on previous all VAT Consultant Exam General Math Questions.

- Practice similar types Question in High School Class-VII & Class-VIII

- Practice Interest and Marginal Cost, Duty Taxes calculation match.

- Scientific calculator are prohibited to use other than normal Calculator.

- You have an option to choice two out of three or four math Question to solve.

Division-05: Bangla & English (1 Session) 10% Marks.

Trainer: Mohammad Zulfiqur Haider

- Focus to solve all Previous VAT Consultant Exam Questions.

- Practice to translate in to Bangla from English grammatical error free answering.

- Practice to translate in to English from Bangla grammatical error free answering.

- Try to read the Daily English News Papers & Journals for language development.